How Health Insurance Works: Key Terms and Concepts Explained

Health insurance is complicated, and you’re not alone if you feel confused about some of the concepts. How health insurance works and why not understanding it can be a disadvantage? Here is an article explaining the basic lingo and features of health insurance, so you can get a sense of how it works in terms of policies, costs, and which plan best suits your needs.

What is Health Insurance?

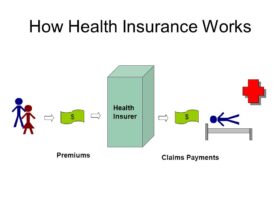

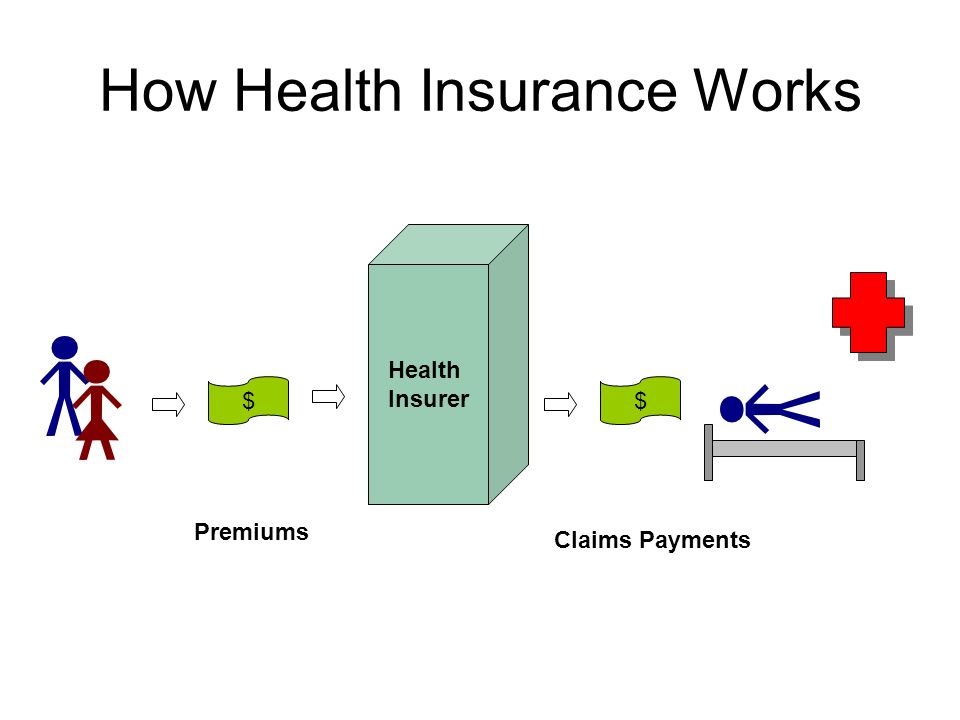

To state it broadly, health insurance is a contract in which the person agrees to pay regular payments (known as premiums) and the insurer agrees to cover part or all costs related to medical care. It can prevent you from getting overwhelmed by massive healthcare bills and allows access to essential medical benefits.

Essential Health Insurance Jargon You Need to Understand

Health insurance starts to make sense once you learn the basic jargon. Below we explain the most important health insurance terms.

- Premium

Premium: The money you pay to the insurance company every month to keep your health coverage active. Paid monthly, quarterly, or annually. Note: Your premium may not cover the full cost of your health care, and you may have deductibles, co-payments, or other out-of-pocket costs.

- Deductible

A deductible is the amount you have to pay for healthcare services in a year before your health insurance plan starts paying its share of costs. For example, with a $1,000 deductible, you pay the first $1,000 of your medical bills before your insurance takes over. Typically, higher deductibles equal lower premiums, and lower deductibles equal higher premiums.

- Copayment (Copay)

Copayment or copay: This is a fixed amount you pay for each health service, such as an office visit to your primary care physician (PCP), prescription drugs, or an emergency room visit. For example, you might have a $30 copay for a primary care visit or no cost for generic medication. The copay helps share the cost of care between the insurer and insured.

- Coinsurance

Your coinsurance is the percentage of healthcare costs you split with your insurer after reaching the deductible. For example, if your coinsurance is 20%, you cover 20% of the cost for a service, and the insurer covers the remaining 80%.

- Out-of-Pocket Maximum

The out-of-pocket maximum is the most you’ll pay for covered healthcare services in a year. Once you reach this limit, the insurance will cover all expenses for the remainder of the year. This does not include your premiums; it applies to deductibles, copayments, and coinsurance.

Kinds of Health Insurance Plans

There are various types of health insurance plans, offering different levels of coverage, costs (deductibles/coinsurance), and flexibility. Knowing these features helps you choose the best plan for your needs.

- Health Maintenance Organizations (HMOs)

HMO plans require members to pick a primary care physician (PCP), who issues referrals for specialists. These plans have lower premiums and out-of-pocket costs but require you to use a predetermined network of providers.

- PPO — Preferred Provider Organization

PPO plans are more flexible, allowing you to choose your providers without referrals. However, they typically have higher premiums and out-of-pocket costs, especially when visiting out-of-network doctors.

- EPO: Exclusive Provider Organization

An EPO plan combines features of HMO and PPO plans. You don’t need referrals for specialists, but coverage is limited to in-network providers. EPOs generally have lower premiums than PPOs but offer less flexibility.

- Point of Service (POS)

POS plans require you to have a primary care physician (PCP) and get referrals for specialists. You can see out-of-network providers, but at a higher cost. POS plans combine aspects of HMO and PPO plans.

Important Health Insurance Coverage Terms

In addition to the basic types of plans and cost-sharing terms, there are other critical elements to be aware of in health insurance coverage:

- Network of Providers

A provider network consists of doctors, hospitals, and other healthcare professionals that offer their services at reduced rates to insurance plan members. In-network providers generally cost less, while using out-of-network providers can result in significantly higher expenses.

- Pre-existing Conditions

A pre-existing condition is a health problem that exists before your insurance policy becomes effective. Under the Affordable Care Act (ACA), insurers cannot refuse coverage or increase premiums due to pre-existing conditions. This helps individuals get coverage for ongoing treatment.

- Preventive Care

Preventive care includes services like check-ups, vaccinations, and screenings designed to keep you healthy or catch diseases early. Many health insurance plans cover preventive care at no additional cost, helping catch minor issues before they become major health problems.

- Formulary

A formulary is a list of prescription drugs covered by your health insurance plan. Formularies are usually divided into tiers, with each tier representing a different cost level. If you take prescription medications, reviewing the formulary can help you understand how much you’ll pay.

Ways to Select the Best Health Insurance Plan

Choosing the right health insurance plan depends on your healthcare needs, budget, and preferences. Consider these steps:

- Evaluate your healthcare needs: How often do you visit doctors, need specialists, or take medications? Your needs determine the best plan type.

- Costs: Compare the premium, deductible, copayment, and coinsurance amounts, as well as the out-of-pocket maximum. Lower premium plans usually have higher deductibles.

- Review the provider network: Ensure your preferred doctors or hospitals are in-network to avoid higher charges.

- Seek additional benefits: Look for plans that offer preventive services, mental health care, and wellness programs to fit your needs.

Conclusion

Understanding health insurance can help you make better choices when selecting a plan. By familiarizing yourself with terms like premium, deductible, copayment, coinsurance, and different health insurance plan types, you can choose the coverage that best fits your health needs and financial situation.

Spending time researching and comparing plans—and consulting professionals if needed—can help you create a policy that’s ideal for you and your family.

Leave a Reply