Choosing the right health insurance plan can be a challenging task, especially with the various options available in the market. Your choice can significantly impact both your health and finances, so it’s essential to understand how to evaluate and select the best plan that meets your specific needs. In this article, we will guide you through the steps to choosing the best health insurance plan by considering factors like coverage, costs, provider networks, and more.

Understand Your Healthcare Needs

The first step in choosing a health insurance plan is understanding your healthcare needs. Ask yourself:

- Do you have any chronic conditions that require regular medical attention?

- Do you take prescription medications frequently?

- How often do you visit specialists?

- Do you have a preferred primary care physician or hospital?

By evaluating your current and potential healthcare needs, you can better determine which health insurance plan will offer the most appropriate coverage.

Types of Health Insurance Plans

Understanding the different types of health insurance plans is crucial for making an informed decision. Here are the most common types:

1. Health Maintenance Organization (HMO) Plans

HMO plans require members to choose a primary care physician (PCP) and get referrals from the PCP to see specialists. These plans often have lower premiums and out-of-pocket costs, but they limit your choice of healthcare providers to a network.

2. Preferred Provider Organization (PPO) Plans

PPO plans offer more flexibility in choosing healthcare providers and specialists without needing a referral. However, they usually come with higher premiums and may result in higher out-of-pocket costs if you go out of the network.

3. Exclusive Provider Organization (EPO) Plans

EPO plans combine elements of both HMOs and PPOs. They offer flexibility without requiring referrals but limit coverage to a specific network of doctors and hospitals.

4. Point of Service (POS) Plans

POS plans require a primary care physician and referrals for specialists but allow you to see out-of-network providers at a higher cost. They offer a middle ground between HMO and PPO plans.

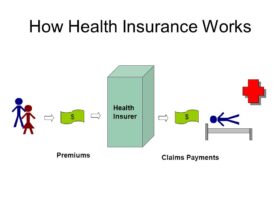

Evaluate the Cost of Health Insurance Plans

When selecting a health insurance plan, it’s important to understand the different costs involved. Here are the key costs to consider:

- Premiums: This is the monthly payment you make to keep your health insurance policy active.

- Deductible: The amount you need to pay out-of-pocket for healthcare services before your insurance starts to cover costs.

- Copayment (Copay): A fixed amount you pay for specific services, such as a doctor’s visit or prescription drugs, after meeting your deductible.

- Coinsurance: The percentage of the cost you share with your insurer after meeting your deductible. For instance, if your coinsurance is 20%, you pay 20% of the costs, and your insurer pays 80%.

- Out-of-Pocket Maximum: The maximum amount you will pay for covered services in a policy year. After reaching this limit, the insurance covers 100% of costs.

Check the Network of Providers

The network of providers is a critical aspect to consider when choosing a health insurance plan. If you have preferred doctors or specialists, make sure they are part of the plan’s network. Going out-of-network can lead to significantly higher costs or even a lack of coverage, depending on the plan type.

1. In-Network Providers

Most health insurance plans have a list of in-network providers who have agreed to offer services at discounted rates. Choosing in-network providers can save you a substantial amount of money.

2. Out-of-Network Providers

If you prefer doctors or hospitals that are out of the network, consider a PPO or POS plan. Be aware that using out-of-network providers often results in higher costs.

Consider Prescription Drug Coverage

If you take prescription medications, it’s important to check the plan’s drug formulary, which is the list of medications covered by the plan. Different plans cover medications at different tiers, affecting your copay or coinsurance. Ensure that your medications are covered at a reasonable cost under the plan you choose.

Review the Plan’s Benefits

Different health insurance plans offer different levels of coverage for services such as mental health care, maternity care, preventive care, and specialist visits. Review the Summary of Benefits and Coverage (SBC) for each plan to understand what is covered and at what cost.

Determine Your Preferred Level of Coverage

When choosing a health insurance plan, it’s crucial to balance the level of coverage with the associated costs. Plans with lower premiums often have higher deductibles and out-of-pocket costs, while plans with higher premiums may offer more comprehensive coverage and lower out-of-pocket expenses.

Utilize Preventive Care Benefits

Most health insurance plans cover preventive care services, such as vaccinations, screenings, and annual check-ups, at no extra cost. These services can help you maintain your health and avoid serious health issues in the future. Make sure your plan covers the preventive care services you need.

Compare Plans Using Online Tools

Many insurance marketplaces and company websites offer comparison tools that allow you to compare different plans side by side. These tools can help you evaluate plans based on premiums, deductibles, out-of-pocket costs, network coverage, and other factors. Use these tools to narrow down your options and find the best plan for you.

Conclusion: Make an Informed Choice

Choosing the best health insurance plan involves understanding your healthcare needs, evaluating different types of plans, and considering costs, coverage, and provider networks. By taking the time to carefully review your options, you can select a plan that provides the coverage you need at a price you can afford.

Health insurance is a crucial part of managing your healthcare expenses and protecting your financial well-being. Make sure to compare plans, read the fine print, and consult with experts if needed to make the best decision for your specific situation. With the right information and approach, you can confidently choose a health insurance plan that meets your needs.

Leave a Reply