INTRODUCTION

Certainly, navigating health insurance is difficult, but understanding how to maximize the benefits of your health insurance can lead to significant savings in the future. In America’s world of rising health care costs. Using your health insurance plan effectively will be essential to ensure that you do not have to pay them out of your own pocket while receiving quality care. In this guide we’ll look at practical strategies that will help you save money on healthcare and get the most from your health benefits.

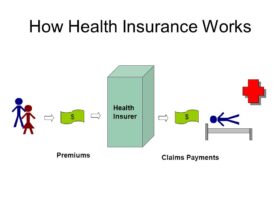

Understanding Your Health Insurance Plan

To effectively use its features, you must first understand such things as what is covered by your plan, what is not, and how much it costs for different types of service.

1. Know Your Plan Details

Start by reviewing your Summary of Benefits and Coverage (SBC). This document provides a detailed overview of what your plan covers, including:

Premiums: How much you pay each month just to keep yourself insured.

Deductibles: The cash you have to pay out-of-pocket until your insurance begins paying.

Copayments (Copays) and Coinsurance: The amounts you split the cost of giving medical care in theory, after meeting your deductible.

Out-of-Pocket Maximum: The most amount of money you will pay for a given year. After this your insurance will cover 100% of the costs.

Knowing these components will help set the health needs of you and you’re budget.

2. Stay In-Network

To avoid unexpected charges, always pick a provider that is in your insurance network. Providers in the network have negotiated rates with your insurance company and therefore make it very cost effective for you. If you use a provider who is not in-network you tend to pay higher charges and this can lead to much larger out-of-pocket costs.

Tips to Maximize Health Insurance Benefits

The way to working with your own Truth is follow these tips:

1. Take advantage of the preventive care services provided by most health insurance plans at no extra cost. These include check-ups, inoculations, many preventative screenings and other preventive services you might like! By using these services, you get the chance to catch potential health problems early. Early intervention can mean less costly treatments down the road and earlier recoveries from disease or injury.

2.Use Health Savings Accounts (HSAs) and Flexible HSA:

Available with Savings Accounts (FSAs) an High-Deductible Health Plan (HDHP), funds roll over yearly and can even grow into retirement money.FSA: Funds are use-it-or-lose-it annually but may be used for a wide range of medical costs

3. Take a look at your prescription drug coverage.

Prescription drugs can be quite expensive. Find out what your plan covers by reading the formulary (the list of covered medications) wherever it is published. Ask your healthcare professional for generic alternatives that are just as effective as the main-label drugs but cost less. You will greatly cut your out-of pocket expenses by using generic drugs.

4. Keep up with the annual plan review.

As a result of life events, changes in income or changes in health conditions you may find that you need different or additional coverage from your health insurance. Make sure your plan still suits you and that you are not paying too much for it when open enrollment periods. On the health insurance exchange or through your employer, comparing plans may provide a more suitable choice which will save you money.

5. Understand Emergency vs. Urgent Care

Recognizing the difference between emergency care and urgent care can prove to be a real moneysaver. Whereas emergency room visits are indispensable in cases of life-threatening situations, they are far costlier than visiting an urgent care center for non life-threatening conditions, like minor injuries or illnesses. By selecting the right level of care, you can benefit from lower copayments and coinsurance.

How to Save Money on Medical Services

1. Obtain Cost Estimates and Bargain Bills

Before undergoing a procedure or treatment, request your provider to provide you with a cost estimate. For bill negotiation, if the estimate is too high, or ask if there are discounts available that might lower costs. Many health care providers give a substantial discount when one pays cash in advance or sets up payment arrangements with them.

2. Utilize Telehealth Services

Telemedicine services have become increasingly popular and are often covered by health insurance plans. They offer a convenient and inexpensive alternative to in-person visits, especially for minor illnesses, follow-up consultations, or mental health services. Using such resources as telehealth can help you reduce your copays and transportation charges.

3. Get Referrals and Pre-Approvals

For certain treatments or visits to specialists, your health insurer may require that you get a referral from your primary care physician (PCP) or pre-authorization first. Always check with your insurance company to see that these conditions are satisfied, to avoid claims being turned down and to keep from racking up bills unexpectedly.

4. Stay Healthy and Live Well

The best way to take advantage of your health insurance is to stay healthy. Keep up those wellness programs, stay on a balanced diet, work out regularly, and effectively control your chronic conditions. Quite a few health insurers offer perks, rebates, or even full refunds on the cost of enrolling in programs for wellness, memberships at health clubs, or participating in smoking cessation programs.

Understanding Your Bills and Explanation of Benefits (EOB)

To prevent mistakes and their cost, carefully go over medical bills and Explanation of Benefits (EOB) make sure that it’s correct’ notice errors in your bills, such as being charged for a service you didn’t receive (or incorrect charges), and call to try and resolve them with the provider and Health insurance company. Staying alert can save you from getting gouged…it ensures you receive the most from your benefits.

Conclusion: Make the Most of Your Health Insurance Coverage

The best way to get the most out of your health insurance benefits is to understand your plan, keep up on preventative care, manage costs with HSAs and FSAs, choose the level of care right for you, and make your health a top priority. By taking advantage of these strategies, you’ll not only save money in healthcare but also maximize what you get from your health insurance program. By being informed about your healthcare, asking questions and making use of all the available benefits that there are for you.

Leave a Reply